Difference between revisions of "Validating invoices"

(→Invoice validation view) |

(→Adding, editing header invoice data in the document view) |

||

| Line 63: | Line 63: | ||

<br/>Click [[Document view tabs|here]] for more information on the different tabs. | <br/>Click [[Document view tabs|here]] for more information on the different tabs. | ||

| − | ==Adding | + | ==Adding and editing header invoice data in the document view== |

| + | The fields available in [[image:fieldsHeader.png|link=]] "Header fields" are in a fixed order. This is determined on a global level, so it can't be changed. | ||

| − | ''' | + | <br/>{{info|For fast moving between the different fields, use the '''Tab''' button on your keyboard.}}<br/> |

| − | + | For more information on which fields are available, see one of the following pages: | |

| − | + | * [[Header_fields_EIS|Header fields EIS]] | |

| − | + | * [[Header_fields_OIS|Header fields OIS]] | |

| − | + | * [[Header_fields_VIS|Header fields VIS]] | |

| − | |||

| − | |||

| + | Some of the fields are prefilled by the scanbatch definitions and/or by the OCR recognition.<br/> | ||

| + | <br/> | ||

| + | Fields prefilled by the scanbatch definition: | ||

| + | <br/>'''All environments''': | ||

| + | * Invoice type | ||

* Journal | * Journal | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | '''EIS and OIS specific fields''': | |

| + | * Period | ||

| − | * Supplier/customer | + | '''VIS specific fields''': |

| + | * Bookyear | ||

| + | * Directly to finish | ||

| + | |||

| + | <br/> | ||

| + | Fields prefilled by the OCR server (only if recognized): | ||

| + | <br/> | ||

| + | * Supplier / customer | ||

* Invoice number | * Invoice number | ||

* Invoice date | * Invoice date | ||

| Line 88: | Line 96: | ||

* OGM | * OGM | ||

* Currency | * Currency | ||

| − | |||

| − | |||

* Total amount | * Total amount | ||

| − | + | '''EIS''' and '''VIS''' will recognize two extra fields: | |

| − | + | * Net amount | |

| − | + | * VAT amount | |

| − | |||

| − | |||

| + | Fields may have different background colours, based on their status: | ||

| + | * '''White''': everything is ok, the field does not contain any errors or doubts. | ||

| + | * '''Yellow''': the recognition server found multiple possibilities. The most probable value is proposed. The other options can be viewed by clicking in the field. Choose the correct value. | ||

| + | * '''Red''': this field is required and no value could be found by the recognition server or the validation check performed on that field returned incorrect. | ||

| − | + | <br/>{{note|In case of a yellow field, you always need to press "Enter" on your keyboard to confirm the value.}} | |

| + | <br/>{{warning|Invoices containing fields with red or yellow backgrounds cannot be transferred to the accountancy package.}} | ||

| + | Some of the header fields are filled in based on the values in other fields. | ||

| + | * '''Due date''': based on the supplier / customer payment term. | ||

| + | * '''Currency''': either recognized by the recognition server or based on the supplier. For more details, see [[Appendix:_Currency|Appendix: Currency]] | ||

| − | |||

| + | To enter data in a field, there are different options available: | ||

| + | * Type a value. | ||

| + | * Pick a value from a [[image:listPicker.png|link=]] "List". | ||

| + | * Pick a value from the [[image:date.png|link=]] "Date" picker. See [[Validating_invoices#Selecting_dates|selecting dates]] for more. | ||

| − | + | <br/>{{note|When there's a list of values available and you start typing a value (the code or the name) for a field, the different available options (based on the text you already typed) appear. Select the right option for you.}} | |

| + | <br/>{{info|You can enter anything you want in a free textfield (like description). No value control will be performed.}} | ||

| + | <br/>{{info|If you have different lists per company (for the same field), the list for that field only shows the available options for the selected company.}} | ||

| + | <br/>{{info|You have the possibility to sort the fields in a list. Your desired sort order is saved, so when you open the same list the next time it's sorted the way you like. The sort order of the autocomplete dropdown list (the list you get when you start typing a value) is inherited of the list.}} | ||

| + | <br/>{{info|If you don't want to see all items in the lookuplist, you can use favourites: | ||

| + | * Click on [[image:favorite_inactive.png|link=]] or [[image:favorite_active.png|link=]] next to each item to add or remove the item in your list of favourites. | ||

| + | * To only show your list favourites, click on the [[image:favorite_toggle.png|link=]] "Favorites only" icon on top of all items. If you want to see all items back again, click [[image:favorite_active.png|link=]] "Favorites only".}} | ||

| + | <br/>{{info|It's also possible to enter calculations in an amount field. Entering 100+100 will result in 200 for example.}} | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

Revision as of 15:05, 27 June 2016

After scanning and recognition (the OCR process), the invoices have to be validated in "My tasklist".

The different options available in the tasklist can be viewed here.

Contents

- 1 Selecting the appropriate document type

- 2 Selecting individual invoices for validation

- 3 Invoice validation view

- 4 Adding and editing header invoice data in the document view

- 5 Adding, editing and deleting posting data in the document view

- 6 Managing posting templates

- 7 Action buttons available for validating invoices

- 8 Automatic header data checks

- 9 Auto completion rules

- 10 Handling attachments to invoices

- 11 Adding comments to invoices

1 Selecting the appropriate document type

Depending upon the settings and the company selected, there are different document types available.

- All environments:

- Incoming invoices

- Incoming mail

- Outgoing invoices

- EIS:

- VAT statement

- VIS:

- Coda

You can choose a document type by hovering over ![]() "Document type". The list with available document types will appear.

"Document type". The list with available document types will appear.

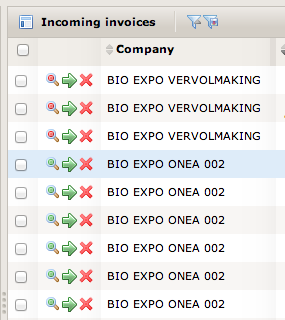

2 Selecting individual invoices for validation

When importing an invoice into 1Archive, a validation check is performed on the invoice. Depending upon the outcome of this check, an invoice can be marked as valid or invalid. This validation status is visible in the list view.

To view an invoice for validation, you can select the magnifier icon at the beginning of the invoice list.

-

"View the document": the document is entirely valid but you are still able to change any field in this invoice.

"View the document": the document is entirely valid but you are still able to change any field in this invoice. -

"View the document": the document is invalid so further validation is needed before you are able to send this invoice to bookkeeping.

"View the document": the document is invalid so further validation is needed before you are able to send this invoice to bookkeeping.

| When a document appears invalid, this means it contains errors or some of the fields are in doubt. There could be multiple possibilities for a field, or a required field was not recognized so you need to enter it manually, ... |

When you open an invalid document, and you make it valid by fixing all errors, the magnifier icon will turn green after pressing the ![]() "Save" button.

"Save" button.

| It is also possible to filter by validation status. |

3 Invoice validation view

The left hand side of the page shows some information about the invoice. Default, the header field data will be shown. Following tabs are available:

-

"Header fields": displaying the header information. Depending upon your environment, you have different fields available:

"Header fields": displaying the header information. Depending upon your environment, you have different fields available:

-

"Technical fields": displaying the technical information.

"Technical fields": displaying the technical information.

-

"Delivery fields": displaying the delivery information.

"Delivery fields": displaying the delivery information. -

"Comments": displaying the comments.

"Comments": displaying the comments. -

"Attachments": displaying the attachments.

"Attachments": displaying the attachments. -

"Related documents": displaying related documents.

"Related documents": displaying related documents. -

"Images": view the different attachments of the document.

"Images": view the different attachments of the document.

The action buttons menu for the document is available above the different tab pages. The visibility of these buttons are dependant upon the workflow status in which the document is at that particular moment.

At the bottom of the page, the accounting lines (posting lines) are available.

| An invoice always has to contain at least one account line! |

The right hand side part of the page default shows the scanned invoice image. Here, there are also a few different tab pages available:

-

"Images": shows the scanned invoice image.

"Images": shows the scanned invoice image. -

"Log": shows all log entries about what happened with the document.

"Log": shows all log entries about what happened with the document. -

"Delivery log": shows all log entries for the delivery of the invoice. This is currently not in use.

"Delivery log": shows all log entries for the delivery of the invoice. This is currently not in use. -

"Log": shows which workflow statuses the document had up until now.

"Log": shows which workflow statuses the document had up until now. -

"Flow visualisation": a visual representation of the workflow log. More information here.

"Flow visualisation": a visual representation of the workflow log. More information here.

Click here for more information on the different tabs.

4 Adding and editing header invoice data in the document view

The fields available in ![]() "Header fields" are in a fixed order. This is determined on a global level, so it can't be changed.

"Header fields" are in a fixed order. This is determined on a global level, so it can't be changed.

| For fast moving between the different fields, use the Tab button on your keyboard. |

For more information on which fields are available, see one of the following pages:

Some of the fields are prefilled by the scanbatch definitions and/or by the OCR recognition.

Fields prefilled by the scanbatch definition:

All environments:

- Invoice type

- Journal

EIS and OIS specific fields:

- Period

VIS specific fields:

- Bookyear

- Directly to finish

Fields prefilled by the OCR server (only if recognized):

- Supplier / customer

- Invoice number

- Invoice date

- Due date

- OGM

- Currency

- Total amount

EIS and VIS will recognize two extra fields:

- Net amount

- VAT amount

Fields may have different background colours, based on their status:

- White: everything is ok, the field does not contain any errors or doubts.

- Yellow: the recognition server found multiple possibilities. The most probable value is proposed. The other options can be viewed by clicking in the field. Choose the correct value.

- Red: this field is required and no value could be found by the recognition server or the validation check performed on that field returned incorrect.

| In case of a yellow field, you always need to press "Enter" on your keyboard to confirm the value. |

| Invoices containing fields with red or yellow backgrounds cannot be transferred to the accountancy package. |

Some of the header fields are filled in based on the values in other fields.

- Due date: based on the supplier / customer payment term.

- Currency: either recognized by the recognition server or based on the supplier. For more details, see Appendix: Currency

To enter data in a field, there are different options available:

- Type a value.

- Pick a value from a

"List".

"List". - Pick a value from the

"Date" picker. See selecting dates for more.

"Date" picker. See selecting dates for more.

| When there's a list of values available and you start typing a value (the code or the name) for a field, the different available options (based on the text you already typed) appear. Select the right option for you. |

| You can enter anything you want in a free textfield (like description). No value control will be performed. |

| If you have different lists per company (for the same field), the list for that field only shows the available options for the selected company. |

| You have the possibility to sort the fields in a list. Your desired sort order is saved, so when you open the same list the next time it's sorted the way you like. The sort order of the autocomplete dropdown list (the list you get when you start typing a value) is inherited of the list. |

If you don't want to see all items in the lookuplist, you can use favourites:

|

| It's also possible to enter calculations in an amount field. Entering 100+100 will result in 200 for example. |

| You have the possibility to calculate in the amount fields. |

For selecting suppliers or customers: see selecting suppliers/customers.

For selecting dates: see selecting dates.

4.1 Selecting suppliers/customers

If you don’t find the appropriate supplier by typing in its name or code in the supplier field you can open the supplier/customer dialog box by clicking ![]() next to the supplier, displaying the list of all suppliers.

next to the supplier, displaying the list of all suppliers.

In the dialog box, you can search the appropriate supplier by typing in a code or name; wildcards can also be used.

If you want to use the advanced supplier search, choose the appropriate filter field on which you want to search. For example on “VAT number” or on “city”.

Enter a value in the next field, ENTER or click “Apply filter”. Suppliers matching the criteria are automatically shown in the supplier list.

The number of suppliers in the list is limited to 10 at a time. To view the other search results, press:

|

| Sorting by clicking on the supplier field name can also facilitate your search. |

| Aliases are not used. |

| When you move the popup window after opening a list |

If you don't want to view all suppliers/customers, you can make use of favourites:

|

4.2 Editing suppliers/customers

Editing the basic supplier data is possible in the supplier dialog box.

After selecting a supplier click on ![]() (Edit) for the supplier which you want to edit. An extra box containing all basic supplier data will open and you can edit the appropriate fields.

(Edit) for the supplier which you want to edit. An extra box containing all basic supplier data will open and you can edit the appropriate fields.

Click ![]() to save your supplier data. By releasing the invoice to your accounting package, the supplier info will also be updated in the accounting package.

to save your supplier data. By releasing the invoice to your accounting package, the supplier info will also be updated in the accounting package.

| Desactivating suppliers can only be done in the accounting package. |

| Not available in KIS. |

4.3 Adding new suppliers/customers

If the appropriate supplier is not available in the supplier list, you can add supplier data by clicking on ![]() (Add). Click

(Add). Click ![]() to save your supplier data.

to save your supplier data.

By releasing the invoice to your accounting package, the supplier will be added in the supplier list and a code will be created automatically.

| The code you enter in the supplier data box will be overwritten in the accounting package, as it is the accounting package which is responsible for assigning supplier codes. After the invoice is definitive booked, the new supplier code will be available in the 1Archive system. |

| Always create a VAT ID following the NEW standard (BE0xx..). |

| When creating a foreign supplier without vat ID, fill in the country code in the vat ID field. |

4.4 Selecting dates

If the appropriate date is not correct or empty, you can change the date by editing this field or by clicking the date picker ![]() and selecting the correct date.

and selecting the correct date.

-

go to the previous month.

go to the previous month. -

go to the previous year.

go to the previous year. -

go to the next month.

go to the next month. -

go to the next year.

go to the next year.

| Use “w” as shortcut for “today” date. |

5 Adding, editing and deleting posting data in the document view

Location: Archive - My tasklist - Invoice View - Posting lines field tab ![]() (Posting line fields)

(Posting line fields)

Editing posting data is only available in “My Tasklist”.

You can fill in the posting data of an invoice in the posting sheet at the bottom of the screen.

- The “Net amount” field is copied from the “Net amount” field of the header. You can change this amount if more posting lines are needed.

- The “Account” is selected by start typing a value (code or name) directly in the account field, the different options appear and you can select the right value.

Data is sorted by the column chosen in the account popup. Another method is by selecting an account from the account list by clicking on next to the account field.

next to the account field. - The “Non deductable VAT” field is copied from a field value of the account. If you want to change you can type any value between 0 and 100.

| You have the possibility to sort the fields in the lookup lists. The sorting order is saved in the lookup list for next use and also for an identical sorting order in the auto complete dropdown. The sorting order in the auto complete dropdown is not saved. |

For instructions on using a posting template to fill in posting data automatically, see Managing posting templates.

To move to the next field of the posting line press TAB.

To create another line in the posting grid you have different possibilities:

- press double TAB at the end of the line

- press down arrow in any field of the last line

- click

(Add line).

(Add line).

Automatically a new line is added containing the open difference net amount as net line amount.

To delete a line click ![]() (Remove line).

(Remove line).

Basic amount calculation is available in the amount fields.

| If a default template is assigned to a supplier, the posting data will be applied automatically during import of the invoice in the 1Archive system. |

| You can resize the width of the columns by selecting the border of the column title and move it to the right or to the left. |

| You have the possibility to calculate in the amount fields. |

6 Managing posting templates

Posting templates will facilitate the posting of data drastically.

6.1 Creating posting templates

Location: Archive - My tasklist - Invoice View > Click “Templates” ![]()

- Click “Template”

in the action button row. The Posting template manager dialog box opens.

in the action button row. The Posting template manager dialog box opens. - Click

(Add template) to create a template.

(Add template) to create a template. - The posting details as filled in the normal posting sheet of the document are copied as posting line fields of the template.

- For the amount field you can use percentage or fixed (value) to distribute the header amount over the posting lines.

If you leave the amount field empty then you have to fill it in when entering the posting data for an invoice during the validation process.- If you use percentage, make sure you will have 100% over all the lines.

- The amount in the template is based on net amounts, without VAT.

- You can add extra lines by clicking the add button

(Add line).

(Add line). - You can delete a line by clicking the delete button

(Remove line).

(Remove line). - You can use Keywords on all text fields of a template (Remarks on header level, Description on posting level)

- For the amount field you can use percentage or fixed (value) to distribute the header amount over the posting lines.

| In the Posting template manager dialog box no auto completion rules are available. |

| Order field will line up the posting details when template is applied. |

- Each created template has its own code and name.

- Code

- Name, the proposed name can be overwritten.

- A template can be bounded to a specific supplier or to be general for the whole company.

- If a supplier is selected, then this template is specific for this supplier.

- If no supplier is selected, the template will be created for the company, not bounded to a specific supplier. This template will not be applied by the processing at import of the invoice.

- If you indicate the template as default, it will be applied automatically by the processing if an invoice is imported for this supplier.

| There can be only one default template per supplier, if you indicate a new template as default template, the older template will become non default. |

| The template is not automatically applied when you change from supplier in the header data. |

| Default template are not used for company bounded templates. |

- To save the template click “Save”, otherwise “back”.

6.2 Edit posting templates

Location: Archive - My tasklist - Invoice View > Click “Templates” ![]()

- Click “Template”

in the action button row. The Posting template manager dialog box opens.

in the action button row. The Posting template manager dialog box opens. - Click

(Edit template) to edit the template.

(Edit template) to edit the template. - To save the changes to the template click “Save”, otherwise “Back”.

6.3 Cancel posting templates

Location: Archive - My tasklist - Invoice View > Click “Templates” ![]()

- Click “Template”

in the action button row. The Posting template manager dialog box opens.

in the action button row. The Posting template manager dialog box opens. - Click

(Remove template) to remove the template.

(Remove template) to remove the template.

7 Action buttons available for validating invoices

Following action buttons are available in the validation screen:

7.1 Close invoice view

Location: Archive - My tasklist/ All documents - Invoice View > Click “Close”

You can close the document without saving the data, by clicking ![]() (Close) in the action button row.

(Close) in the action button row.

7.2 Save invoice data

Location: Archive - My tasklist - Invoice View > Click “Save”

You can save the validated data, by clicking ![]() (Save) in the action button row, without sending the invoice to the accounting package.

(Save) in the action button row, without sending the invoice to the accounting package.

7.3 Send invoice to the accounting package

Location: Archive - My tasklist - Invoice View > Click “Set ready for download”

After validating the invoice header fields and adding the posting lines, you can send the invoice to the accounting package by clicking ![]() (Set ready for download) in the action button row.

(Set ready for download) in the action button row.

7.4 Cancel an invoice

Location: Archive - My tasklist - Invoice View > Click “Cancel document”

If you don’t want to transfer the invoice to the accounting package you can cancel the invoice by clicking ![]() (Cancel document) in the action button row.

(Cancel document) in the action button row.

You have always to give a cancel reason when canceling an invoice.

| Depending on your settings in “My account” after clicking the above mentioned buttons you will see the list or the next invoice in the list. |

7.5 Apply template

Location: Archive - My tasklist - Invoice View > Click “Templates” ![]()

- Click “Template”

in the action button row. The Posting template manager dialog box opens.

in the action button row. The Posting template manager dialog box opens. - A list of available templates for the selected supplier and the company bounded templates are displayed.

- If no supplier is selected, only the company bounded templates are proposed.

- Select a template. The posting details of the selected template are shown at the bottom.

- To apply the selected template click “Apply template”, otherwise “Cancel”.

- After applying, the posting grid of the document will be updated by the posting grid of the template you applied.

| If there is a correction amount, then this amount will be added on a new line. |

- Example: If you have a line with fixed amount 100 € in your template and the invoice has a net amount of 300 €,

the correction amount of 200 € will be added on an extra line, if there was not a second line defined.

- Example: If you have a line with fixed amount 100 € in your template and the invoice has a net amount of 300 €,

7.6 Save as template

Refer to Managing posting templates.

8 Automatic header data checks

The system checks the invoice data and accounting lines against control data such as periods and Vat tables.

- Check on duplicate invoice number for same supplier. Check based on same supplier, same invoice type and number, invoice date within the same year.

- Net amount plus Vat amount has to be equal to total amount in the header data.

- Sum of all posting line net amounts has to be equal to the net amount in the header data.

- Vat check: The sum of the calculated vat amount of all posting lines has to be equal to the vat amount in the header data.

| The total vat amount has a tolerance of 0.02 when calculating the sum of the calculated vat amount of all posting lines. |

Ex. Vat = 21%; Total net amount = 100.06; Total Vat amount = 21,01; Total amount = 121,07

2 lines of each net amount 50,03 result into a vat total of 21,02

- Vat period and fiscal periods have to be open, and has to be in the selected “year”.

Invalid fields are colored in red background.

9 Auto completion rules

In order to facilitate the input of header and posting data, 1Archive has built in different auto completion rules:

10 Handling attachments to invoices

Location: Invoice view > click ![]() (Attachments)

(Attachments)

You can only add attachments to an invoice in following status in My Tasklist:

- To validate

- Exception handling

10.1 Adding attachments to invoices:

- In the invoice view, click

(Attachments).

(Attachments). - Click

(Add attachment) under “Attachments” if you want to upload a new attachment.

(Add attachment) under “Attachments” if you want to upload a new attachment. - Click

(Add version) next to the filename if you want to upload a new version of this attachment.

(Add version) next to the filename if you want to upload a new version of this attachment. - Choose the file for upload.

- Select “Exportable” if you want that this attachment is automatically included in PDF downloads.

- Click “Save” to save the attachment to the invoice or “Back”.

- The attachment overview list contains following information:

- Filename of attachment.

- User who has uploaded the attachment.

- Date of upload.

- Automatically exportable to PDF: yes or no.

10.2 Adding attachments to invoices via drag and drop:

- In the invoice view, click

(Attachments).

(Attachments). - Drag one or multiple files from your desktop and drop them in your browser window.

- You will get a confirmation of the uploaded files.

- After clicking on OK, you will see the new attachments in the list.

- Attachments will by default be marked as exportable.

| Drag and drop functionality is only compatible with Google Chrome. |

10.3 Removing attachments from invoices:

- Select the attachment or version of the attachment you want to remove by clicking on

(remove attachment).

(remove attachment). - Note that the scanned invoices cannot be removed.

10.4 Downloading attachments from invoices:

- Select the attachment or version of the attachment you want to download by clicking on

(download attachment).

(download attachment).

10.5 Viewing attachments from invoices:

- Select the attachment or version of the attachment you want to view in the right part of your screen

(open attachment).

(open attachment).

11 Adding comments to invoices

Location: Invoice view > click ![]() (Comments tab)

(Comments tab)

You can only add comments to an invoice in the following status in My Tasklist:

- To validate.

- Exception handling.

Adding comments to invoices:

- In the invoice view, click

(Comments).

(Comments). - Enter the comment you want underneath next to the “Save” button.

- Click “Save” to save your comment.

- Time and user are added automatically.

| No comments can be removed. |