Recognition process

From 1Archive help

Automatic recognition of the invoice's header fields is based on Kofax Transformation Modules (KTM) and is only applied to the first page of the invoice.

Fields that are automatically recognized:

- Supplier/customer

- Invoice number

- Invoice date

- Due date

- OGM

- Currency

- Net amount

- Vat amount

- Total amount

| It is important that your supplier/customer database is up-to-date, this to improve your recognition rate. The VAT numbers and bank accounts are used by Kofax to search for the invoice’s supplier code. The VAT number is only used for searching the customer code. |

1 General recognition rules

Some of the recognized fields need to meet some conditions:

- Supplier/customer: these fields are searched in the database, based on the VAT ID, bank account, IBAN number, website or e-mail address.

- Invoice date: the value can't be older than 6 months and can't be in the future.

- Due date: can't be earlier than the invoice date.

- OGM: is checked for validity (modulo 97).

- Total amount: if the total amount equals the sum of the net and VAT amount, the field is valid. If not, the field is invalid.

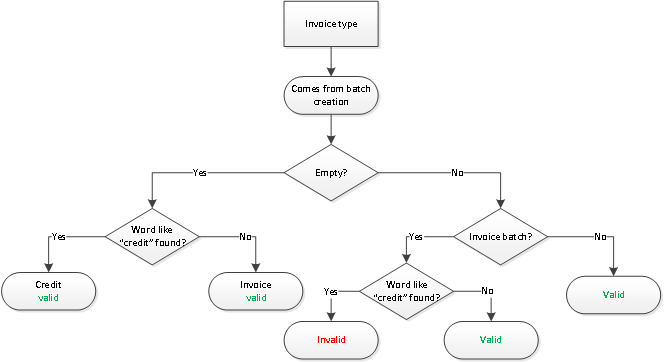

1.1 Invoice type

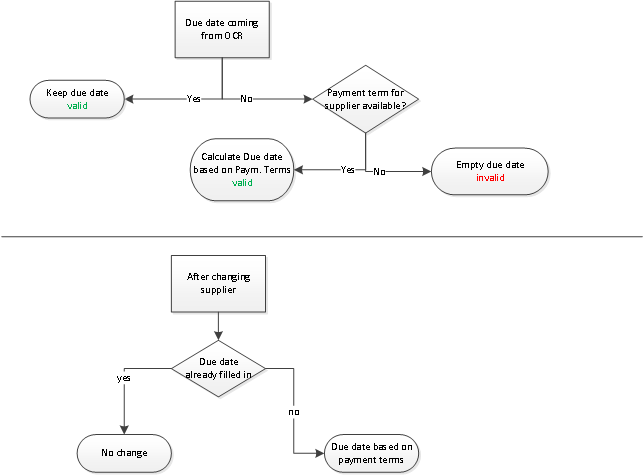

1.2 Due date

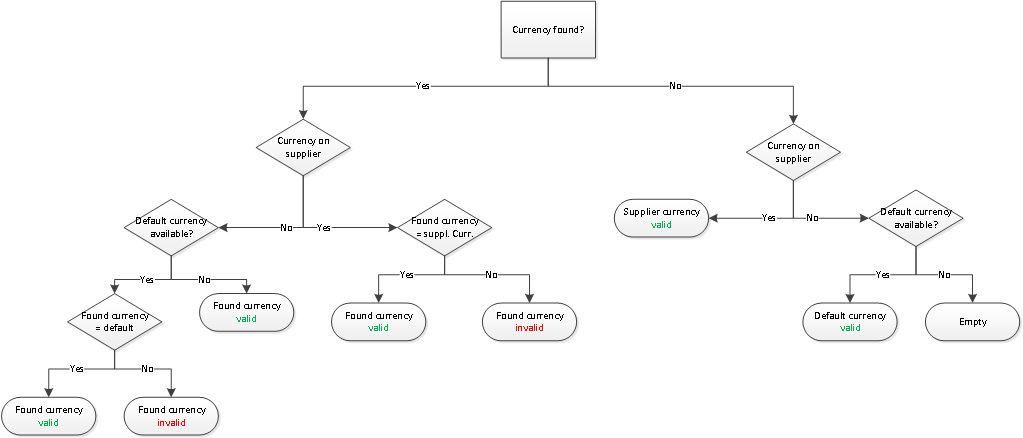

1.3 Currency