Recognition process

From 1Archive help

Automatic recognition of the invoice's header fields is based on ABBYY or Kofax Transformation Modules (KTM) and is only applied to the first page of the invoice.

Fields that are automatically recognized:

- Supplier/customer

- Invoice number

- Invoice date

- OGM

- Currency

- Net amount

- Vat amount

- Total amount

| It is important that your supplier/customer database is up-to-date, this to improve your recognition rate. |

Contents

1 Red, yellow and orange fields

After the recognition process, fields can be colored in different background colors:

- Yellow: there are different possibilities available. The most probable value is proposed. When selecting the field, all possible values are proposed.

| When a yellow field is available, you always need to confirm the value. A document will not be entirely valid when there are yellow fields available. Press "Enter" or "Tab" on your keyboard to confirm a value. |

- Red: this field is required, but no value could be found in the recognition process or the validation check performed on that field did not succeed.

- Orange: no existing supplier/customer could be found with the data found on the invoice. The system gives you the possibility to add a new supplier/customer with the new data. Click the

"Add" button to create the new partner.

"Add" button to create the new partner.

| Invoices with red, yellow or orange fields can't be booked into the accountancy package. |

2 Supplier/customer recognition

Suppliers are recognized based on following fields:

- VAT ID

- Bank account

- IBAN number

- Website

- E-mail address

Customers are recognized based on following fields:

- VAT ID

- For VIS: e-mail address

3 General recognition rules

Some of the recognized fields need to meet some conditions:

- Invoice date: the value can't be older than 6 months and can't be in the future.

- Due date: can't be earlier than the invoice date.

- OGM: is checked for validity (modulo 97).

- Total amount: if the total amount equals the sum of the net and VAT amount, the field is valid. If not, the field is invalid.

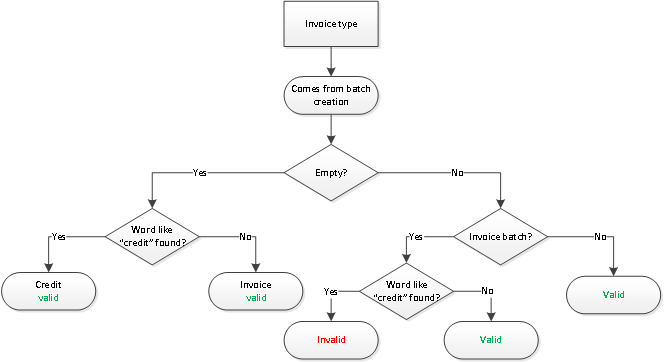

3.1 Invoice type

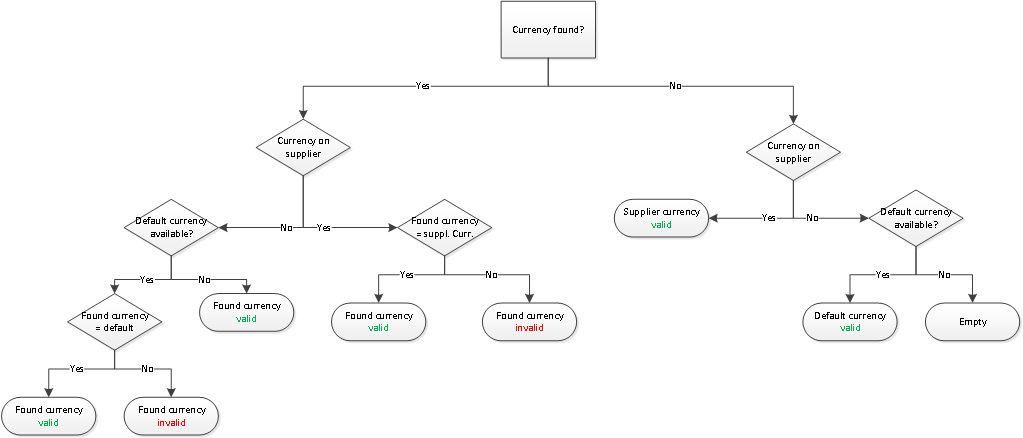

3.2 Currency