Validating invoices

After scanning, and the OCR process (recognition) the invoices have to be validated in “My tasklist”.

In “My tasklist” you have two subdivisions:

- “To Validate”: invoices to be validated and booked.

- “Exception handling”: invoices in status invalid, which need special attention.

Contents

- 1 Selecting the appropriate document type

- 2 Selecting individual invoices for validation

- 3 Invoice validation view

- 4 Adding, editing header invoice data in the document view

- 5 Adding, editing and deleting posting data in the document view

- 6 Managing posting templates

- 7 Action buttons available for validating invoices

- 8 Automatic header data checks

- 9 Auto completion rules

- 10 Handling attachments to invoices

- 11 Adding comments to invoices

- 12 Share read-only copy of document

1 Selecting the appropriate document type

Two different document types per company are available:

- Incoming documents, for processing the incoming invoices and credit notes.

- Outgoing document, for processing the outgoing invoices and credit notes.

You can toggle between these two document types by hovering ![]() and selecting the appropriate document type.

and selecting the appropriate document type.

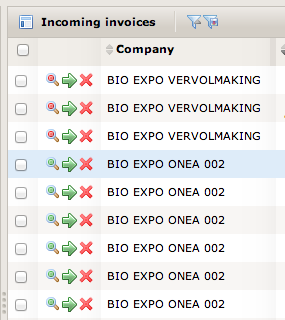

2 Selecting individual invoices for validation

Location: Archive - My Tasklist – Invoice list

To select the invoice for validation, you can select following icon at the beginning of the invoice list.

-

: View this document. The document was already validated correctly but still you are able to change any field in this invoice.

: View this document. The document was already validated correctly but still you are able to change any field in this invoice. -

: View this document. The document was already validated incorrectly so still further validation is needed before you are able to send this invoice to bookkeeping.

: View this document. The document was already validated incorrectly so still further validation is needed before you are able to send this invoice to bookkeeping.

When importing an invoice to KIS, a validation check is immediately performed on the invoice. Depending on the outcome of this check, an invoice can be marked as valid or invalid.

This validation status is visible in the list view. The magnifier icon which is in front of the row to open the document, colors red ![]() when the invoice is invalid.

when the invoice is invalid.

Invalid means: it contains errors or some of the fields are in doubt – multiple values possible or field needs to be entered).

The magnifier icon colors green ![]() when the document is entirely valid.

when the document is entirely valid.

When you open an invalid document, and you make it valid by fixing all errors, the magnifier icon will color green after pressing the Save button.

It is also possible to filter on the validation status.

3 Invoice validation view

The left hand side of the page shows the information of the invoice header fields (header data).

At the top of the header fields you have following icons available:

-

(Header fields) displaying the header information.

(Header fields) displaying the header information.

- Invoice information

- Journal

- Invoice type: Invoice/Credit note

- Supplier/customer: depending if incoming or outgoing invoice

- Invoice nr

- Invoice date

- Due date

- Year

- Fiscal period

- VAT period

- OGM: Only incoming invoices

- Comment

- Currency

- Net amount

- Vat amount

- Total amount

- Financial discount

- Discount %

- Booking information

- Voucher nr: returned from bookkeeping application - Not editable

- Voucher date: returned from bookkeeping application - Not editable

- Invoice information

-

(Technical fields) displaying the technical information.

(Technical fields) displaying the technical information.

- ScanPRO ID, identification number in the ScanPRO system.

- Current workflow status of the document.

- “Validation”: indicating that the invoice still has to be validated.

- “Create”: in case of manual adding an invoice, still to be validated.

- “Exception”: indicating that the invoice is possible invalid, e.g. duplicate invoice.

- “Cancelled”: invoice is canceled.

- “Wait feedback”: invoice is sent to the accounting system and is waiting for an update with voucher number and date.

- “Ended”: invoice is fully processed.

- Indexed: Yes/No, indicating if a full text search indexing has been performed on the document.

- Reception method, the way the document came into the system:

- Web scanning

- Manual creation (add document)

- XML (electronic invoice)

- Scan user

- Scanning date.

- Incoming date into ScanPRO.

- Cancel reason, in case the invoice has been scanned.

- Accountant, the person who booked or cancelled the invoice.

-

(Attachments) displaying the attachments.

(Attachments) displaying the attachments. -

(Comments) displaying comments.

(Comments) displaying comments. -

(Related documents) displaying related documents, not in use for current version.

(Related documents) displaying related documents, not in use for current version.

The action menu for the document is displayed above the header fields. The availability of the functions in the menu bar are dependent on the workflow status.

The lines at the bottom of the page are the account lines (posting lines). An invoice has always to contain at least one account line.

The right hand side part of the page shows the scanned invoice image. If the document consists of several attachments, you can browse using the arrow buttons in the bottom right of the image screen.

-

go to the first attachment.

go to the first attachment. -

go to the previous attachment.

go to the previous attachment. -

go to the last attachment.

go to the last attachment. -

go to the next attachment.

go to the next attachment.

Use the acrobat scroll bar to navigate to a specific page in the document.

At the left bottom of the image screen you have following possibilities:

-

(Download) for downloading the image.

(Download) for downloading the image. -

(Detach) for detaching the image and putting it on a second screen, this will facilitate the input of data. If you want to disable the detachment, just close the detached screen.

(Detach) for detaching the image and putting it on a second screen, this will facilitate the input of data. If you want to disable the detachment, just close the detached screen.

Possibilities only available after definitive booking in the accounting package:

-

(Signature) for downloading the signature of the image.

(Signature) for downloading the signature of the image. -

(Public key) for downloading the public key of the image.

(Public key) for downloading the public key of the image. -

(Validate) for checking if current image has been modified since archiving.

(Validate) for checking if current image has been modified since archiving. - Annotating information on top of the invoice image: date/time when feedback received from accounting package (voucher number), voucher number and accountant.

On the left top of the image screen you have two buttons; one for selecting the image, the second to view the invoice log.

You can toggle between invoice image view and invoice log view, by clicking on the appropriate icon:

-

(Images) image view.

(Images) image view. -

(Log) invoice log view.

(Log) invoice log view.

All invoices have a log which contains all the events related to the invoice. The log is updated with following information:

- Import: When a document arrives in the archive, a log entry is added.

- Processing: A log entry will be added for each step during automatic processing, like thumbnail creation, annotating, signing, routing of the document.

When an error occurs during processing, a log entry of type “Error” will also be added. - User action: When a user performs following actions:

- Set ready for download.

- Cancel document.

- No log is added when changes are made in the header or line fields at moment of saving.

4 Adding, editing header invoice data in the document view

Location: Archive - My tasklist - Invoice View - Header tab ![]() (default)

(default)

Validating header data is only available in “My tasklist”.

The field order you view is general and cannot be changed.

To move from one field to another, use TAB.

If your system has different lookup lists for different companies, the lookup lists contain options specific to the selected company.

Some of the fields are prefilled by the scan batch definitions and by the scanning (OCR) results.

Fields that are filled in by the scan batch definitions, if selected, are:

- Journal

- Invoice type

- Year

- Fiscal period

- Vat period

Fields that are filled in by the OCR (recognition) server, if recognized, are:

- Supplier/customer

- Invoice number

- Invoice date

- Due date

- OGM

- Currency

- Net amount

- Vat amount

- Total amount

Fields can have different background colors:

- Yellow : the scanning has found different possibilities, the most probable value is proposed, by clicking on the field you can see and select the other possible values.

| You always need to press ENTER to confirm a yellow field. |

- Red : the values of these fields are required and not found by the OCR server or the validation check performed on that field is not correct.

| No invoices with fields in yellow or red background can be transferred to the accounting package. |

Some header fields are filled in automatically based on the values available in the other fields.

- “Tax system”: based on a field of the supplier data.

- “Tax %”: based on a field of the supplier data. (Only incoming invoices)

- “Due date”: automatically filled in by the recognition server or calculated based on the supplier/customer payment term. For details of the due date proposition see Appendix Due date.

- “Currency”: for details see Appendix Currency.

You have different options to enter data:

- In a free text field, like description, you can enter whatever you want, no value control will be performed.

- Start typing a value (code or name) directly in the field, the different options appears and you can select the right value (auto completion dropdown).

- Selecting a value from a lookup list, having a search button

| You have the possibility to sort the fields in the lookup lists. The sorting orders is saved in the lookup list for next use and also for an identical sorting order in the auto complete dropdown. The sorting order in the auto complete dropdown is not saved. |

If you don't want to view all items from the lookuplist, you can make use of favourites:

|

| You have the possibility to calculate in the amount fields. |

For selecting suppliers or customers: see selecting suppliers/customers.

For selecting dates: see selecting dates.

4.1 Selecting suppliers/customers

If you don’t find the appropriate supplier by typing in its name or code in the supplier field you can open the supplier/customer dialog box by clicking ![]() next to the supplier, displaying the list of all suppliers.

next to the supplier, displaying the list of all suppliers.

In the dialog box, you can search the appropriate supplier by typing in a code or name; wildcards can also be used.

If you want to use the advanced supplier search, choose the appropriate filter field on which you want to search. For example on “VAT number” or on “city”.

Enter a value in the next field, ENTER or click “Apply filter”. Suppliers matching the criteria are automatically shown in the supplier list.

The number of suppliers in the list is limited to 10 at a time. To view the other search results, press:

|

| Sorting by clicking on the supplier field name can also facilitate your search. |

| Aliases are not used. |

| When you move the popup window after opening a list |

If you don't want to view all suppliers/customers, you can make use of favourites:

|

4.2 Editing suppliers/customers (N.A.)

4.3 Adding new suppliers/customers

If the appropriate supplier is not available in the supplier list, you can add supplier data by clicking on ![]() (Add). Click

(Add). Click ![]() to save your supplier data.

to save your supplier data.

By releasing the invoice to your accounting package, the supplier will be added in the supplier list and a code will be created automatically.

| The code you enter in the supplier data box will be overwritten in the accounting package, as it is the accounting package which is responsible for assigning supplier codes. After the invoice is definitive booked, the new supplier code will be available in the ScanPRO system. |

| Always create a VAT ID following the NEW standard (BE0xx..). |

| When creating a foreign supplier without vat ID, fill in the country code in the vat ID field. |

4.4 Selecting dates

If the appropriate date is not correct or empty, you can change the date by editing this field or by clicking the date picker ![]() and selecting the correct date.

and selecting the correct date.

-

go to the previous month.

go to the previous month. -

go to the previous year.

go to the previous year. -

go to the next month.

go to the next month. -

go to the next year.

go to the next year.

| Use “w” as shortcut for “today” date. |

5 Adding, editing and deleting posting data in the document view

Location: Archive - My tasklist - Invoice View - Posting lines field tab ![]() (Posting line fields)

(Posting line fields)

Editing posting data is only available in “My Tasklist”.

You can fill in the posting data of an invoice in the posting sheet at the bottom of the screen.

- The “Net amount” field is copied from the “Net amount” field of the header. You can change this amount if more posting lines are needed.

- The “Account” is selected by start typing a value (code or name) directly in the account field, the different options appear and you can select the right value.

Data is sorted by the column chosen in the account popup. Another method is by selecting an account from the account list by clicking on next to the account field.

next to the account field. - The “Non deductable VAT” field is copied from a field value of the account. If you want to change you can type any value between 0 and 100.

| You have the possibility to sort the fields in the lookup lists. The sorting order is saved in the lookup list for next use and also for an identical sorting order in the auto complete dropdown. The sorting order in the auto complete dropdown is not saved. |

For instructions on using a posting template to fill in posting data automatically, see Managing posting templates.

To move to the next field of the posting line press TAB.

To create another line in the posting grid press double TAB at the end of the line or click ![]() (Add line). Automatically a new line is added containing the open difference net amount as net line amount.

(Add line). Automatically a new line is added containing the open difference net amount as net line amount.

To delete a line click ![]() (Remove line).

(Remove line).

Basic amount calculation is available in the amount fields.

| If a default template is assigned to a supplier, the posting data will be applied automatically during import of the invoice in the ScanPRO system. |

| You can resize the width of the columns by selecting the border of the column title and move it to the right or to the left. |

| You have the possibility to calculate in the amount fields. |

6 Managing posting templates

Posting templates will facilitate the posting of data drastically.

6.1 Creating posting templates

Location: Archive - My tasklist - Invoice View > Click “Templates” ![]()

- Click “Template”

in the action button row. The Posting template manager dialog box opens.

in the action button row. The Posting template manager dialog box opens. - Click

(Add template) to create a template.

(Add template) to create a template. - The posting details as filled in the normal posting sheet of the document are copied as posting line fields of the template.

- For the amount field you can use percentage or fixed (value) to distribute the header amount over the posting lines.

If you leave the amount field empty then you have to fill it in when entering the posting data for an invoice during the validation process.- If you use percentage, make sure you will have 100% over all the lines.

- The amount in the template is based on net amounts, without VAT.

- You can add extra lines by clicking the add button

(Add line).

(Add line). - You can delete a line by clicking the delete button

(Remove line).

(Remove line). - You can use Keywords on all text fields of a template (Remarks on header level, Description on posting level)

- For the amount field you can use percentage or fixed (value) to distribute the header amount over the posting lines.

| In the Posting template manager dialog box no auto completion rules are available. |

| Order field will line up the posting details when template is applied. |

- Each created template has its own code and name.

- Code

- Name, the proposed name can be overwritten.

- A template can be bounded to a specific supplier or to be general for the whole company.

- If a supplier is selected, then this template is specific for this supplier.

- If no supplier is selected, the template will be created for the company, not bounded to a specific supplier. This template will not be applied by the processing at import of the invoice.

- If you indicate the template as default, it will be applied automatically by the processing if an invoice is imported for this supplier.

| There can be only one default template per supplier, if you indicate a new template as default template, the older template will become non default. |

| The template is not automatically applied when you change from supplier in the header data. |

| Default template are not used for company bounded templates. |

- To save the template click “Save”, otherwise “back”.

6.2 Edit posting templates

Location: Archive - My tasklist - Invoice View > Click “Templates” ![]()

- Click “Template”

in the action button row. The Posting template manager dialog box opens.

in the action button row. The Posting template manager dialog box opens. - Click

(Edit template) to edit the template.

(Edit template) to edit the template. - To save the changes to the template click “Save”, otherwise “Back”.

6.3 Cancel posting templates

Location: Archive - My tasklist - Invoice View > Click “Templates” ![]()

- Click “Template”

in the action button row. The Posting template manager dialog box opens.

in the action button row. The Posting template manager dialog box opens. - Click

(Remove template) to remove the template.

(Remove template) to remove the template.

7 Action buttons available for validating invoices

Following action buttons are available in the validation screen:

7.1 Close invoice view

Location: Archive - My tasklist/ All documents - Invoice View > Click “Close”

You can close the document without saving the data, by clicking ![]() (Close) in the action button row.

(Close) in the action button row.

7.2 Save invoice data

Location: Archive - My tasklist - Invoice View > Click “Save”

You can save the validated data, by clicking ![]() (Save) in the action button row, without sending the invoice to the accounting package.

(Save) in the action button row, without sending the invoice to the accounting package.

7.3 Send invoice to the accounting package

Location: Archive - My tasklist - Invoice View > Click “Set ready for download”

After validating the invoice header fields and adding the posting lines, you can send the invoice to the accounting package by clicking ![]() (Set ready for download) in the action button row.

(Set ready for download) in the action button row.

7.4 Cancel an invoice

Location: Archive - My tasklist - Invoice View > Click “Cancel document”

If you don’t want to transfer the invoice to the accounting package you can cancel the invoice by clicking ![]() (Cancel document) in the action button row.

(Cancel document) in the action button row.

You have always to give a cancel reason when canceling an invoice.

| Depending on your settings in “My account” after clicking the above mentioned buttons you will see the list or the next invoice in the list. |

7.5 Apply template

Location: Archive - My tasklist - Invoice View > Click “Templates” ![]()

- Click “Template”

in the action button row. The Posting template manager dialog box opens.

in the action button row. The Posting template manager dialog box opens. - A list of available templates for the selected supplier and the company bounded templates are displayed.

- If no supplier is selected, only the company bounded templates are proposed.

- Select a template. The posting details of the selected template are shown at the bottom.

- To apply the selected template click “Apply template”, otherwise “Cancel”.

- After applying, the posting grid of the document will be updated by the posting grid of the template you applied.

| If there is a correction amount, then this amount will be added on a new line. |

- Example: If you have a line with fixed amount 100 € in your template and the invoice has a net amount of 300 €,

the correction amount of 200 € will be added on an extra line, if there was not a second line defined.

- Example: If you have a line with fixed amount 100 € in your template and the invoice has a net amount of 300 €,

7.6 Save as template

Refer to Managing posting templates.

8 Automatic header data checks

The system checks the invoice data and accounting lines against control data such as periods and Vat tables.

- Check on duplicate invoice number for same supplier. Check based on same supplier, same invoice type and number, invoice date within the same year.

- Net amount plus Vat amount has to be equal to total amount in the header data.

- Sum of all posting line net amounts has to be equal to the net amount in the header data.

- Vat check: The sum of the calculated vat amount of all posting lines has to be equal to the vat amount in the header data.

| The total vat amount has a tolerance of 0.02 when calculating the sum of the calculated vat amount of all posting lines. |

Ex. Vat = 21%; Total net amount = 100.06; Total Vat amount = 21,01; Total amount = 121,07

2 lines of each net amount 50,03 result into a vat total of 21,02

- Vat period and fiscal periods have to be open, and has to be in the selected “year”.

Invalid fields are colored in red background.

9 Auto completion rules

In order to facilitate the input of header and posting data, ScanPRO has built in different auto completion rules:

- Copy of the assigned tax system of the chosen supplier, to the "tax system" field in the header data.

- Copy of the assigned tax % of the chosen supplier, to the ‘tax %’ field in the header data.

- Copy of the assigned account of the chosen supplier, to all "account" fields on the posting lines. (only for Expert/M)

- Copy of the "tax system" field in the header data to the "tax system" fields on the posting lines.

- Copy of the "tax %" field in the header data to the "tax %" fields on the posting lines. (only for incoming invoices)

- Copy of the "non deductable" field available in the account record, to the "non deductable" fields on the posting lines.

In case no value is available zero will be filled in the "non deductable" field.

10 Handling attachments to invoices

Location: Invoice view > click ![]() (Attachments)

(Attachments)

You can only add attachments to an invoice in following status in My Tasklist:

- To validate

- Exception handling

Adding attachments to invoices:

- In the invoice view, click

(Attachments).

(Attachments). - Click

(Add attachment) under “Attachments” if you want to upload a new attachment.

(Add attachment) under “Attachments” if you want to upload a new attachment. - Click

(Add version) next to the filename if you want to upload a new version of this attachment.

(Add version) next to the filename if you want to upload a new version of this attachment. - Choose the file for upload.

- Select “Exportable” if you want that this attachment is automatically included in PDF downloads.

- Click “Save” to save the attachment to the invoice or “Back”.

- The attachment overview list contains following information:

- Filename of attachment.

- User who has uploaded the attachment.

- Date of upload.

- Automatically exportable to PDF: yes or no.

Adding attachments to invoices via drag and drop:

- In the invoice view, click

(Attachments).

(Attachments). - Drag one or multiple files from your desktop and drop them in your browser window.

- You will get a confirmation of the uploaded files.

- After clicking on OK, you will see the new attachments in the list.

Removing attachments from invoices:

- Select the attachment or version of the attachment you want to remove by clicking on

(remove attachment).

(remove attachment). - Note that the scanned invoices cannot be removed.

Downloading attachments from invoices:

- Select the attachment or version of the attachment you want to download by clicking on

(download attachment).

(download attachment).

Viewing attachments from invoices:

- Select the attachment or version of the attachment you want to view in the right part of your screen

(open attachment).

(open attachment).

11 Adding comments to invoices

Location: Invoice view > click ![]() (Comments tab)

(Comments tab)

You can only add comments to an invoice in the following status in My Tasklist:

- To validate.

- Exception handling.

Adding comments to invoices:

- In the invoice view, click

(Comments).

(Comments). - Enter the comment you want underneath next to the “Save” button.

- Click “Save” to save your comment.

- Time and user are added automatically.

| No comments can be removed. |

It is possible to share a document with a person that doesn't have access to KIS. This person will only see the shared document as a read-only copy. He will not have access to any other documents and he will not be able to make any changes.

- In the document view, under the image, click "Share document" button

- Copy the link that is shown on screen

- Send link to person with whom you want the share current document