Recognition process

From 1Archive help

Revision as of 10:16, 12 April 2018 by Nele.scherrens (talk | contribs)

Automatic recognition of the invoice's header fields is based on Kofax Transformation Modules (KTM) and is only applied to the first page of the invoice.

Fields that are automatically recognized:

- Supplier/customer

- Invoice number

- Invoice date

- OGM

- Currency

- Net amount

- Vat amount

- Total amount

| It is important that your supplier/customer database is up-to-date, this to improve your recognition rate. |

Contents

1 Red, yellow and orange fields

After the recognition process, fields can be colored in different background colors:

- Yellow: there are different possibilities available. The most probable value is proposed. When selecting the field, all possible values are proposed.

| When a yellow field is available, you always need to confirm the value. A document will not be entirely valid when there are yellow fields available. Press "Enter" or "Tab" on your keyboard to confirm a value. |

- Red: this field is required, but no value could be found in the recognition process or the validation check performed on that field did not succeed.

- Orange: no existing supplier/customer could be found with the data found on the invoice. The system gives you the possibility to add a new supplier/customer with the new data. Click the

"Add" button to create the new partner.

"Add" button to create the new partner.

| Invoices with red, yellow or orange fields can't be booked into the accountancy package. |

2 Supplier/customer recognition

Suppliers are recognized based on following fields:

- VAT ID

- Bank account

- IBAN number

- Website

- E-mail address

Customers are recognized based on following fields:

- VAT ID

- For VIS: e-mail address

3 General recognition rules

Some of the recognized fields need to meet some conditions:

- Invoice date: the value can't be older than 6 months and can't be in the future.

- Due date: can't be earlier than the invoice date.

- OGM: is checked for validity (modulo 97).

- Total amount: if the total amount equals the sum of the net and VAT amount, the field is valid. If not, the field is invalid.

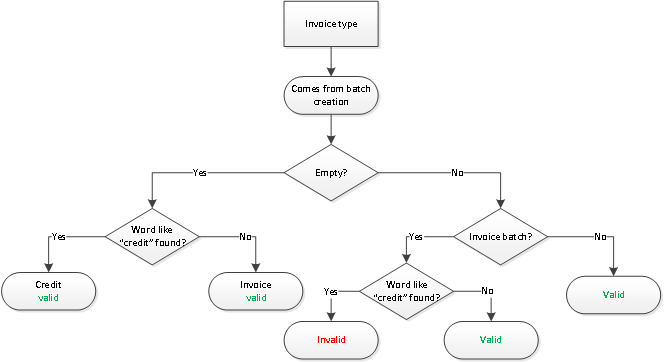

3.1 Invoice type

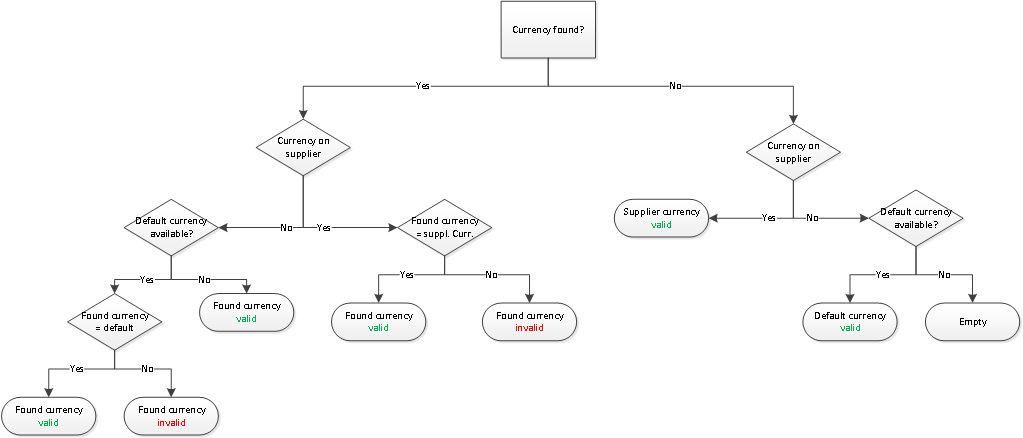

3.2 Currency