Difference between revisions of "Settings"

(→Payment terms) |

(→Partner groups) |

||

| Line 29: | Line 29: | ||

<br/>{{info|It is recommended to first export an Excel, add/edit the lines you want and then import the Excel file again.}}<br/> | <br/>{{info|It is recommended to first export an Excel, add/edit the lines you want and then import the Excel file again.}}<br/> | ||

| + | |||

| + | '''How to export and import again?'''<br/> | ||

| + | The export and import buttons are located next to the page navigation on top of the screen.<br/> | ||

| + | <br/>[[image:export_import_buttons.png|link=]]<br/> | ||

| + | <br/> | ||

| + | # Click the [[image:pageXls.png|link=]] "Export to Excel button". | ||

| + | # If your browser asks you what to do with the file, click "Save". | ||

| + | # Locate the file on your system. It should be in the "Downloads" folder. | ||

| + | # Open the file and add/edit the lines you want. | ||

| + | # Go back to your browser and click the [[image:upload.png|link=]] "Import from Excel" button. | ||

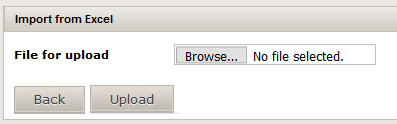

| + | # Click "Browse" on the screen that appears and locate the edited Excel file. Finally, click open. | ||

| + | <br/>[[image:import_from_excel.png|link=]]<br/> | ||

| + | <br/> | ||

Fields that are available: | Fields that are available: | ||

Revision as of 15:01, 28 June 2017

When a user has the "Super accountants" role available, a "Settings" button appears next to "My account" in the upper right corner of the page:

In the settings, following options are available:

-

"Workflow"

"Workflow" -

"Partner groups" Only for Connected users!

"Partner groups" Only for Connected users! -

"Lookup lists" Only for Connected users!

"Lookup lists" Only for Connected users!

Contents

1 Workflow

Available items in this setting:

- Incoming invoices

- Outgoing invoices

In the workflow, you can add/edit TOA rules. To know more about this, please visit our "Approval manual".

2 Partner groups

| This option is only available for Connected users! |

Available items in this setting:

- Customers

- Supplier

Partners are added via an import of an Excel file. This can be done by using following buttons:

-

"Export to Excel"

"Export to Excel" -

"Import from Excel"

"Import from Excel"

| It is recommended to first export an Excel, add/edit the lines you want and then import the Excel file again. |

How to export and import again?

The export and import buttons are located next to the page navigation on top of the screen.

![]()

- Click the

"Export to Excel button".

"Export to Excel button". - If your browser asks you what to do with the file, click "Save".

- Locate the file on your system. It should be in the "Downloads" folder.

- Open the file and add/edit the lines you want.

- Go back to your browser and click the

"Import from Excel" button.

"Import from Excel" button. - Click "Browse" on the screen that appears and locate the edited Excel file. Finally, click open.

Fields that are available:

- INSTANCE: this is currently not in use. Please do not enter a value here.

- COMPANY: the code of the company for which the partners are uploaded.

| Make sure you use the code of the current selected company! |

- ACTIVE: should the partner be active or not? Possible values are:

- TRUE

- FALSE

- CODE: a unique identifier of the partner for this company.

- NAME: the name of the partner.

- VATDIM1 (VAT regime): the code from the "Code" field of an item from the "Purchase/Sales VATDIM1" lookuplist. For example: "00" for national.

- VATDIM2 (VAT %): the code from the "Code" field of an item from the "Purchase/Sales VATDIM2" lookuplist. For example: "21" for 21%.

- VATDIM3: this is currently not in use. Please do not enter a value here.

- ADDRESS1: the first address line of the partner.

- ADDRESS2: the second address line of the partner.

- ADDRESS3: the third address line of the partner.

- ZIP: the zip code of the city where the partner is located.

- CITY: the city where the partner is located.

- COUNTRY: the country where the partner is located.

- VATID: the VAT ID of the partner. Format: BE0883668416

- SUPPLIEREMAIL or CUSTOMEREMAIL: the e-mail address of the partner.

- PAYMENTTERM: the default payment term which should be used for this partner. Make sure you fill in the code of the item from the "Payment terms" lookuplist. For example: "0.02" for financial discount of 2%.

- ACCOUNT: the default account which should be used for this partner. Make sure you fill in the code of the item from the "Accounts" lookuplist. For example: "600000" for purchases.

- CURRENCY: the default currency which should be used for this partner. Make sure you fill in the code of the item from the "Currencies" lookuplist. For example: "EUR" for Euro.

- WEBSITE: the website of the partner.

Supplier specific fields:

- BANKIBAN: the IBAN number for the supplier.

- BANKBIC: the BIC code for the supplier.

- CHAMBEROFCOMMERCE: the chamber of commerce number for the supplier. This is only used in The Netherlands!

- DIM1: the code from the "Code" field of an item from the "DIM1" lookuplist. This could be a cost place for example.

| Make sure you have a company selected when you want to import/export partners, otherwise you will only be able to view all partners of all your companies. |

| When you export the list to Excel to be able to update a partner and you change the code of one of them, it will be added as a new partner. The code will not be updated! |

| When you want to remove a partner, update it to be inactive (set the "ACTIVE" field to "FALSE"). Removing a line won't remove the partner in the list! |

3 Lookup lists

| This option is only available for Connected users! |

Available items in this setting:

- Accounts: the list of account numbers which will be used for your accounting.

- Bank accounts: the bank accounts of your company. These can be used with our payment module.

- Cancel reasons: when a document is cancelled, a reason needs to be given. Those reasons are located here. This list cannot be edited.

- Countries: a list with all available countries.

- Currencies: the list with the currencies used for your company.

- DIM1: the first list for dimensions (used for analytical accounting). This could be a cost center.

- DIM2: the second list for dimensions (used for analytical accounting). This could be a cost unit.

- DIM3: the third list for dimensions (used for analytical accounting). This could be a cost type.

- DIM4: the fourth list for dimensions (used for analytical accounting). This is currently not in use.

- DIM5: the fifth list for dimensions (used for analytical accounting). This is currently not in use.

- DIM6: the sixth list for dimensions (used for analytical accounting). This is currently not in use.

- DIM7: the seventh list for dimensions (used for analytical accounting). This is currently not in use.

- DIM8: the eighth list for dimensions (used for analytical accounting). This is currently not in use.

- DIM9: the ninth list for dimensions (used for analytical accounting). This is currently not in use.

- Invoice types: the list with the available invoice types. This list cannot be edited.

- Payment status: a list with the available payment statuses. These are used with our payment module. This list cannot be edited.

- Payment terms: the list with the payment terms which can be used for your partners.

- Period: the list of financial periods which are used for your accounting.

- Post-control usergroup: a list with all the available user groups with users who will be handling documents in post-control. This list cannot be edited.

- Pre-control usergroup: a list with all the available user groups with users who will be handling documents in pre-control. This list cannot be edited.

- Purchase journals: the journals which will be used for your incoming documents.

- Purchase VATDIM1 (VAT regime): the first list for purchase VAT dimensions.

- Purchase VATDIM2 (VAT %): the second list for purchase VAT dimensions.

- Purchase VATDIM3: this is currently not in use.

- Sales journals: the journals which will be used for your outgoing documents.

- Sales VATDIM1 (VAT regime): the first list for sales VAT dimensions.

- Sales VATDIM2 (VAT %): the second list for sales VAT dimensions.

- Sales VATDIM3: this is currently not in use.

- VAT table incoming: the table which is responsible for the VAT calculations for incoming documents.

- VAT table outgoing: the table which is responsible for the VAT calculations for outgoing documents.

| VAT table incoming/outgoing is a predefined list and should not be changed! |

Lookuplist items are added via an import of an Excel file. This can be done by using following buttons:

-

"Export to Excel"

"Export to Excel" -

"Import from Excel"

"Import from Excel"

| It is recommended to first export an Excel, add/edit the lines you want and then import the Excel file again. |

| Make sure you have a company selected when you want to import/export lookuplist items, otherwise you will only be able to view all lookuplist items of all your companies. |

| When you export the list to Excel to be able to update an item and you change the code of one of them, it will be added as a new item. The code will not be updated! |

| When you want to remove an item, update it to be inactive (set the "ACTIVE" field to "FALSE"). Removing a line won't remove the item in the list! |

3.1 Fields for the lookuplists that can be edited

- INSTANCE: This is currently not in use. Please do not enter a value here.

- COMPANY: the code of the company for which you want to upload the items.

| Make sure you use the code of the current selected company! |

- ACTIVE: should the item be active or not? Possible values are:

- TRUE

- FALSE

- CODE: a unique identifier of the item. This should be unique for the current selected company and the current selected lookuplist.

- NAME: the name of the item.

- NAME_en: the name of the item in English.

- NAME_nl: the name of the item in Dutch.

- NAME_fr: the name of the item in French.

Some lists also have some extra fields that are available for editing.

3.1.1 Accounts

- NONDED: the non deductable percentage.

- VATDIM1_IN (VAT regime): the code from the "Code" field of an item of the "Purchase VATDIM1" list. For example: "00" for national.

- VATDIM2_IN (VAT %): the code from the "Code" field of an item of the "Purchase VATDIM2" list. For example: "21" for 21%.

- VATDIM3_IN: this is currently not in use. Please do not enter a value here.

- DIM1: the code from the "Code" field of an item of the "DIM1" list. For example: "GHT" for Ghent.

- DIM2: the code from the "Code" field of an item of the "DIM2" list. For example: "MKT" for marketing.

- DIM3: the code from the "Code" field of an item of the "DIM3" list. For example: "BE" for Belgium.

- VATDIM1_OUT (VAT regime): the code from the "Code" field of an item of the "Sales VATDIM1" list. For example: "00" for national.

- VATDIM2_OUT (VAT %): the code from the "Code" field of an item of the "Sales VATDIM2" list. For example: "21" for 21%.

- VATDIM3_OUT: this is currently not in use. Please do not enter a value here.

3.1.2 Bank accounts

| For bank accounts, the IBAN number is entered in the "CODE" field. |

- BIC: the BIC code for the bank account.

- BANKACCOUNTCOUNTRY: the country code of the country of the bank account.

- BANKNAME: the name of the bank of the bank account.

- DEFAULTBANKACCOUNT: should the bank account be default or not? Possible values are:

- TRUE

- FALSE

3.1.3 Currencies

- RATE: enter the rate value. This can be a number with up to 6 digits behind the comma.

- MULTIPLIER: enter the multiplier value. This can only be a number with 2 digits behind the comma.

- DEFAULT: should the currency be default or not? Possible values are:

- TRUE

- FALSE

3.1.4 Payment terms

- FREEMONTH: should the invoice date be raised till the end of the month to calculate the payment term? Possible values are:

- TRUE

- FALSE

- DAYS: the number of days that should be added to the invoice date after the free month has been processed.

- TILLEOM: when set to "TRUE", the date will be raised till the end of the month after adding the number of days.

- DAYSAFTEREOM: after applying the till end of month parameter, another extra number of days can be added.

- DEFAULT: should the payment term be the default one? Possible values are:

- TRUE

- FALSE

- PAYDISCOUNT: does the payment term include a financial discount? Possible values are:

- TRUE

- FALSE

- DAYSDISCOUNT: the number of days within the invoice should be paid so the financial discount can be used.

- DISCPRCTG: enter the percentage of the financial discount.

- CALCULATION: when entered "NETT", the financial discount will be calculated based on the netto amount. When entered "GROSS", the financial discount will be calculated based on the total amount.

| It is recommended to use "NETT" for the calculation method. |

3.1.5 Period

- STARTDATE: the date on which the period is starting. Format: 20170623.

- ENDDATE: the date on which the period is ending. Format: 20170623.

- DEFAULT: should this be the default period? Possible values are:

- TRUE

- FALSE

3.1.6 Purchase/Sales journals

- DEFAULT: should this be the default purchase/sales journal? Possible values are:

- TRUE

- FALSE

4 Order of import

For the import of the different partners and lists, you need to respect the order in which they should be imported.

- Analytical dimensions (DIM1 up to and including DIM3)

- Purchase/sales VAT dimensions

- Period

- Payment terms

- Currencies

- Accounts

- Purchase/sales journals

- Customer/supplier

5 Remarks for import

When importing partners and lists, there are a few remarks you should keep in mind.

- The order of import is very important (see above)

- Only .xls files are supported, .xlsx won't work

- The format of numbers should be 0.00

- Percentages and numbers should be marked with a leading single quote (') to avoid automatic cell formatting in Excel

- When an Excel file has more than 1000 lines, the import will time out. Please split your lines into separate files if you have more than 1000 items