Difference between revisions of "General process overview"

From 1Archive help

| Line 10: | Line 10: | ||

#* Onea transfert | #* Onea transfert | ||

#* UnifiedPost Community (BillToBox) | #* UnifiedPost Community (BillToBox) | ||

| + | #* Mobile Scanning | ||

# Automatic recognition of the main header fields of the invoice. | # Automatic recognition of the main header fields of the invoice. | ||

# Import into the 1Archive system. | # Import into the 1Archive system. | ||

Revision as of 16:58, 8 October 2018

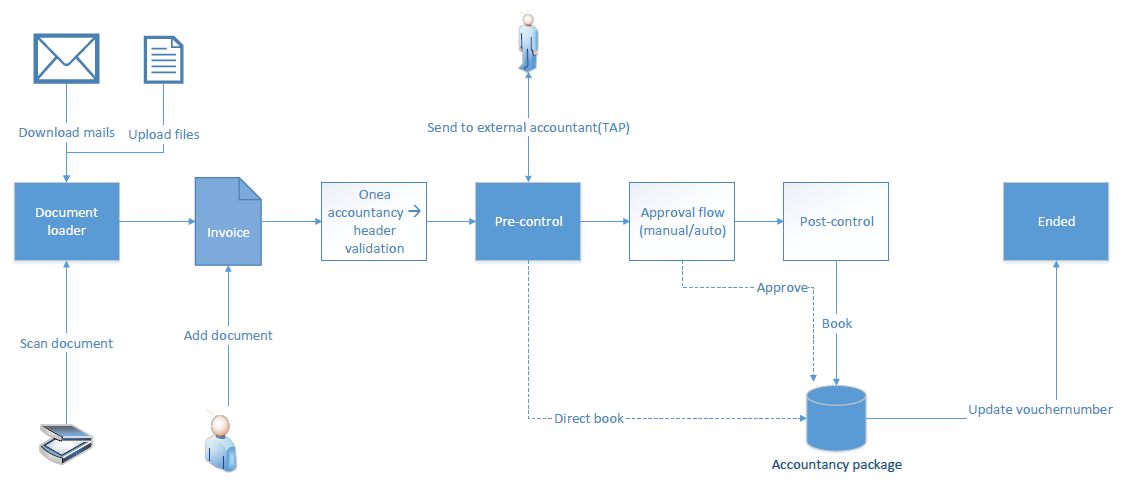

There are different steps in the general process:

- Capturing of the invoice image (data) by

- Webscanning (scanning over the internet)

- Mail import

- Paper invoices

- E-invoices

- Image file upload

- E-invoice file upload

- Onea transfert

- UnifiedPost Community (BillToBox)

- Mobile Scanning

- Automatic recognition of the main header fields of the invoice.

- Import into the 1Archive system.

- Validation process:

- Accountants will:

- Validate the recognized header fields.

- Evaluate the proposed accounting lines based on supplier templates.

- Add the necessary accounting lines.

- Invoice data and accounting lines are checked against control data such as periods and VAT tables.

- In case there was a duplicate invoice detected, or something went wrong during the import, the invoice will appear in "Exception handling".

- These invoices need special attention!

- Accountants will:

- Upon finalization the invoice data is exported to the accounting system.

- The accounting system will assign the voucher number and update the invoice information in the 1Archive system.

- When voucher number is available in 1Archive, the invoice image will be signed and annotated, in order to legal archive the invoice image.

- From then on the invoice image will be available for retrieval from the accounting system and from 1Archive.

The 1Archive application is fully integrated with your accountancy package. Suppliers, accounts, currencies, payment terms, journals and periods are synchronized between both systems.

| For OIS, there is a specific Tax system |

A visual overview of the general process: