Validating samples: Special cases

1 Financial discount

The calculation of the VAT amount is always based on the taxable amount. This taxable amount will be different when working with a financial discount than when working with no financial discount.

1.1 Example

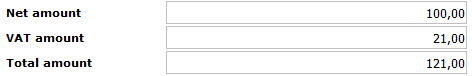

Let's say you have following document in 1Archive:

- Net amount: €100

- VAT percentage: 21%

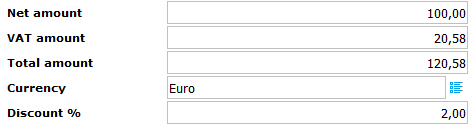

- Discount %: 2

In a normal situation, the VAT amount would be €21 and the Total amount would be €121.

A financial discount is in this case calculated based on the value in the Net amount field. The discount in this example equals €2 (2% of €100).

The taxable amount will therefor be equal to €98 (€100 - €2 discount).

Because the VAT amount is calculated based on the taxable amount, this value will equal €20,58 (21% of €98).

The Total amount in this case will be €120,58. And this is how this document should be booked into the accountancy package.

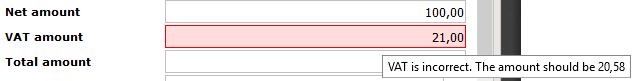

1Archive automatically calculates the financial discount. When the VAT amount is not filled in correctly, this will be displayed by showing a red field. When hovering over that red field, an error message is shown. |