Difference between revisions of "Appendix: Partner settings"

(→Quick VAT) |

(→Quick VAT) |

||

| Line 54: | Line 54: | ||

<br/> | <br/> | ||

| − | '''Default value''': empty. | + | '''Default value''': empty.<br/> |

| + | <br/> | ||

| + | |||

| + | Limitations of the usage of Quick VAT:<br/> | ||

| + | * It should only be used with acounting packages that do not specify a VAT type and percentage on the posting lines. This is because the VAT % is not important on line level when quick VAT is enabled. You can choose any VAT % as long as the sum of the line net amounts is matching the header net amount. | ||

| + | * Only allowed for invoices with VAT type normal or not submitted. The other VAT types use a displacement of the VAT while booking the document. When this displacement booking is made, you need to know the VAT % of each line to be able to calculate the correct displacement amount and assign it to the correct VAT box on the VAT declaration. | ||

| + | * Not in combination with a non deductable VAT amount. When using a non deductable VAT percentage, the non deductable part of the VAT amount should be added to the cost amount while booking. | ||

| + | * Not in combination with an analytical booking. When using an analytical booking, you need to split the amount to different cost centers. There is no use for quick VAT in that case. | ||

| + | <br/> | ||

| + | '''Example''':<br/> | ||

| + | <br/> | ||

| + | ''Invoice header'': | ||

| + | * Net amount: € 100,00 | ||

| + | * VAT amount: € 15;30 | ||

| + | * Total amount: € 115,30 | ||

| + | <br/> | ||

| + | [[image:quick_vat.jpg|link=]] | ||

Revision as of 17:32, 26 January 2017

There are four different settings which can be defined for a partner. These settings will be synchronized with Venice.

| 1Archive needs full access to these four fields. Any existing field will be overwritten. |

- Required field

- Validate amount

- STP

- Quick VAT

| If those settings aren't available in Venice yet, they will be added with a default value. |

1 Required field

This check allows you to indicate a field as required. This is used for certain suppliers which need to have a certain code defined.

Fields that can be marked as required:

- H_OGM: Header - OGM (only for incoming invoices)

- H_COMMENT1: Header - Remark

- P_LINEDESC: Posting line - Description

| The codes marked in bold (H_OGM, H_COMMENT1 and P_LINEDESC) are the codes which are added to the field in Venice. |

Default value: no mandatory field.

2 Validate amount

This field has two available values:

- True

- False

What will happen if choosing true?

Every document that enters 1Archive will indicate following fields as yellow fields:

- Net amount

- VAT amount

- Total amount

This means that every document for the concerned partner has to be validated before it can be sent to the accountancy package.

Default value: true.

3 STP

This field has two available values:

- True

- False

What will happen if choosing true?

When a document enters 1Archive and it's completely recognized and valid, it is processed automatically. This processing depends upon your company settings:

- When auto flow is set to true: the document will be sent into the auto flow based on the TOA rules configured.

- When auto flow is set to false: the document will be sent to the accountancy package.

Default value: false.

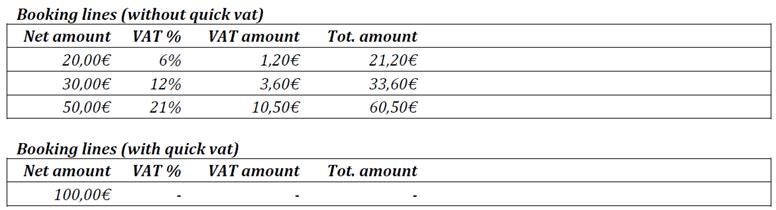

4 Quick VAT

| This field is only available for Suppliers. |

Via the Quick VAT functionality it is possible for the AP user to book a document with multiple VAT % as a single line. When enabled, the VAT check that is performed on the lines will be skipped, the validation of Net amount, VAT amount and Total amount on header level will still be performed.

This field has two available values:

- True

- False

Default value: empty.

Limitations of the usage of Quick VAT:

- It should only be used with acounting packages that do not specify a VAT type and percentage on the posting lines. This is because the VAT % is not important on line level when quick VAT is enabled. You can choose any VAT % as long as the sum of the line net amounts is matching the header net amount.

- Only allowed for invoices with VAT type normal or not submitted. The other VAT types use a displacement of the VAT while booking the document. When this displacement booking is made, you need to know the VAT % of each line to be able to calculate the correct displacement amount and assign it to the correct VAT box on the VAT declaration.

- Not in combination with a non deductable VAT amount. When using a non deductable VAT percentage, the non deductable part of the VAT amount should be added to the cost amount while booking.

- Not in combination with an analytical booking. When using an analytical booking, you need to split the amount to different cost centers. There is no use for quick VAT in that case.

Example:

Invoice header:

- Net amount: € 100,00

- VAT amount: € 15;30

- Total amount: € 115,30