Difference between revisions of "Validating samples: Special cases"

| Line 1: | Line 1: | ||

==Financial discount== | ==Financial discount== | ||

| + | The calculation of the VAT amount is always based on the taxable amount. This taxable amount will be different when working with a financial discount than when working with no financial discount. | ||

| + | |||

| + | === Example=== | ||

| + | Let's say you have following document in 1Archive:<br/> | ||

| − | |||

* '''Net amount''': €100 | * '''Net amount''': €100 | ||

* '''VAT percentage''': 21% | * '''VAT percentage''': 21% | ||

| + | * '''Discount %''': 2 | ||

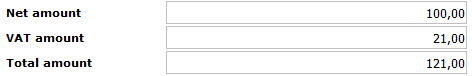

In a normal situation, the ''VAT amount'' would be €21 and the ''Total amount'' would be €121.<br/> | In a normal situation, the ''VAT amount'' would be €21 and the ''Total amount'' would be €121.<br/> | ||

| − | + | <br/>[[image:financial_discount_normal_situation.png|link=]]<br/> | |

| − | + | <br/> | |

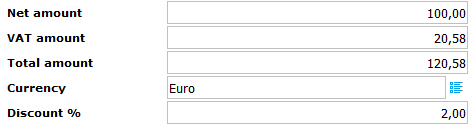

| − | + | A financial discount is always calculated based on the value in the ''Net amount'' field. The discount in this example equals €2 (2% of €100).<br/> | |

| − | + | The taxable amount will therefor be equal to €98 (€100 - €2 discount).<br/> | |

| − | + | Because the ''VAT amount'' is calculated based on the taxable amount, this value will equal €20,58 (21% of €98).<br/> | |

| − | The ''Total amount'' will | + | The ''Total amount'' in this case will be €120,58. And this is how this document should be booked into the accountancy package. |

| + | |||

| + | <br/>[[image:financial_discount.png|link=]]<br/> | ||

| + | |||

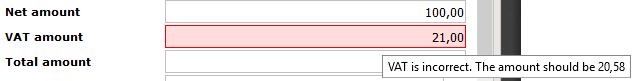

| + | <br/>{{info|1Archive automatically calculates the financial discount. When the ''VAT amount'' is not filled in correctly, this will be displayed by showing a red field. When hovering over that red field, an error message is shown.<br/> | ||

| + | <br/>[[image:financial_discount_validator.PNG|link=]]<br/>}}<br/> | ||

Revision as of 15:14, 7 November 2016

1 Financial discount

The calculation of the VAT amount is always based on the taxable amount. This taxable amount will be different when working with a financial discount than when working with no financial discount.

1.1 Example

Let's say you have following document in 1Archive:

- Net amount: €100

- VAT percentage: 21%

- Discount %: 2

In a normal situation, the VAT amount would be €21 and the Total amount would be €121.

A financial discount is always calculated based on the value in the Net amount field. The discount in this example equals €2 (2% of €100).

The taxable amount will therefor be equal to €98 (€100 - €2 discount).

Because the VAT amount is calculated based on the taxable amount, this value will equal €20,58 (21% of €98).

The Total amount in this case will be €120,58. And this is how this document should be booked into the accountancy package.

1Archive automatically calculates the financial discount. When the VAT amount is not filled in correctly, this will be displayed by showing a red field. When hovering over that red field, an error message is shown. |