Difference between revisions of "Validating samples: Special cases"

From 1Archive help

(→Credit limit) |

|||

| Line 14: | Line 14: | ||

[[image:FinancialDiscount.png|326x132px|link=]] | [[image:FinancialDiscount.png|326x132px|link=]] | ||

| − | |||

| − | |||

Revision as of 13:40, 9 January 2014

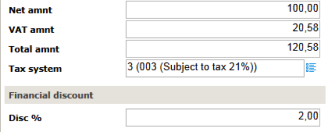

Financial discount or discount for cash

In case of a financial discount the booking entry will be as follows:

Example, for an invoice of net amount 100 € and financial discount of 2%:

- Net amount = 100 €

- Taxable amount: 98 €

- 100 € – 2%

- Vat amount = 20,58 €

- Calculation based on the taxable amount

- 21% of 98 €

- Calculation based on the taxable amount

- Total amount = 120, 58 €