Difference between revisions of "Validating samples: Special cases"

From 1Archive help

| Line 12: | Line 12: | ||

* Total amount = 120, 58 € | * Total amount = 120, 58 € | ||

| − | [[image:FinancialDiscount.png| | + | |

| + | [[image:FinancialDiscount.png|326x132px|link=]] | ||

== Credit limit == | == Credit limit == | ||

Revision as of 16:43, 17 December 2013

1 Financial discount or discount for cash

In case of a financial discount the booking entry will be as follows:

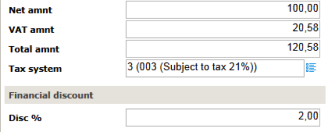

Example, for an invoice of net amount 100 € and financial discount of 2%:

- Net amount = 100 €

- Taxable amount: 98 €

- 100 € – 2%

- Vat amount = 20,58 €

- Calculation based on the taxable amount

- 21% of 98 €

- Calculation based on the taxable amount

- Total amount = 120, 58 €