Difference between revisions of "Appendix: Partner settings"

(→Quick VAT) |

|||

| (2 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| − | + | <br/>{{warning|''"Connected"'' users don't have these settings!}}<br/> | |

| − | <br/>{{warning| | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

==Required field== | ==Required field== | ||

| Line 31: | Line 25: | ||

==STP== | ==STP== | ||

| + | <br/>{{warning|For VIS users: STP should not be used with a document with multiple posting lines. It will only work for documents with only 1 posting line.}}<br/> | ||

This field has two available values: | This field has two available values: | ||

* True | * True | ||

| Line 40: | Line 35: | ||

* When auto flow is set to <u>'''false'''</u>: the document will be sent to the accountancy package. | * When auto flow is set to <u>'''false'''</u>: the document will be sent to the accountancy package. | ||

<br/> | <br/> | ||

| − | '''Default value''': false. | + | '''Default value''': false.<br/> |

| + | '''Default value in VIS''': true. | ||

==Quick VAT== | ==Quick VAT== | ||

| + | <br/>{{warning|This setting is for VIS users only!}} | ||

<br/>{{warning|This field is only available for ''Suppliers''.}} | <br/>{{warning|This field is only available for ''Suppliers''.}} | ||

<br/>{{warning|Quick VAT should not be used in combination with a financial discount. This because the calculation of the discount will be skipped.}}<br/> | <br/>{{warning|Quick VAT should not be used in combination with a financial discount. This because the calculation of the discount will be skipped.}}<br/> | ||

| Line 70: | Line 67: | ||

<br/> | <br/> | ||

[[image:quick_vat.jpg|link=]] | [[image:quick_vat.jpg|link=]] | ||

| + | |||

| + | ==Attention for VIS users== | ||

| + | These settings will be synchronized with Venice.<br/> | ||

| + | <br/>{{warning|1Archive needs full access to these four fields. Any existing field will be overwritten.}} | ||

| + | <br/>{{info|If those settings aren't available in Venice yet, they will be added with a default value.}}<br/> | ||

Latest revision as of 10:12, 3 July 2017

| "Connected" users don't have these settings! |

1 Required field

This check allows you to indicate a field as required. This is used for certain suppliers which need to have a certain code defined.

Fields that can be marked as required:

- H_OGM: Header - OGM (only for incoming invoices)

- H_COMMENT1: Header - Remark

- P_LINEDESC: Posting line - Description

| The codes marked in bold (H_OGM, H_COMMENT1 and P_LINEDESC) are the codes which are added to the field in Venice. |

Default value: no mandatory field.

2 Validate amount

This field has two available values:

- True

- False

What will happen if choosing true?

Every document that enters 1Archive will indicate following field as yellow:

- Total amount

This means that every document for the concerned partner has to be validated before it can be sent to the accountancy package.

Default value: true.

3 STP

| For VIS users: STP should not be used with a document with multiple posting lines. It will only work for documents with only 1 posting line. |

This field has two available values:

- True

- False

What will happen if choosing true?

When a document enters 1Archive and it's completely recognized and valid, it is processed automatically. This processing depends upon your company settings:

- When auto flow is set to true: the document will be sent into the auto flow based on the TOA rules configured.

- When auto flow is set to false: the document will be sent to the accountancy package.

Default value: false.

Default value in VIS: true.

4 Quick VAT

| This setting is for VIS users only! |

| This field is only available for Suppliers. |

| Quick VAT should not be used in combination with a financial discount. This because the calculation of the discount will be skipped. |

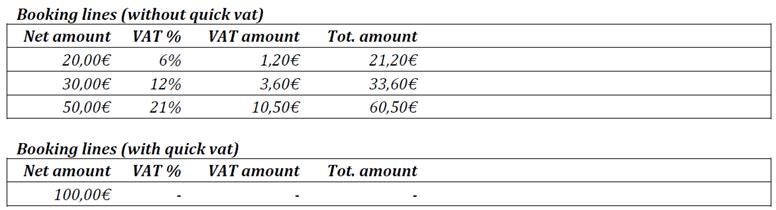

Via the Quick VAT functionality it is possible for the AP user to book a document with multiple VAT % as a single line. When enabled, the VAT check that is performed on the lines will be skipped, the validation of Net amount, VAT amount and Total amount on header level will still be performed.

This field has two available values:

- True

- False

Default value: empty.

Limitations of the usage of Quick VAT:

- It should only be used with acounting packages that do not specify a VAT type and percentage on the posting lines. This is because the VAT % is not important on line level when quick VAT is enabled. You can choose any VAT % as long as the sum of the line net amounts is matching the header net amount.

- Only allowed for invoices with VAT type normal or not submitted. The other VAT types use a displacement of the VAT while booking the document. When this displacement booking is made, you need to know the VAT % of each line to be able to calculate the correct displacement amount and assign it to the correct VAT box on the VAT declaration.

- Not in combination with a non deductable VAT amount. When using a non deductable VAT percentage, the non deductable part of the VAT amount should be added to the cost amount while booking.

- Not in combination with an analytical booking. When using an analytical booking, you need to split the amount to different cost centers. There is no use for quick VAT in that case.

Example:

Invoice header:

- Net amount: € 100,00

- VAT amount: € 15;30

- Total amount: € 115,30

5 Attention for VIS users

These settings will be synchronized with Venice.

| 1Archive needs full access to these four fields. Any existing field will be overwritten. |

| If those settings aren't available in Venice yet, they will be added with a default value. |