Difference between revisions of "Validating samples: Special cases"

| Line 21: | Line 21: | ||

<br/>{{info|1Archive automatically calculates the financial discount. When the ''VAT amount'' is not filled in correctly, this will be displayed by showing a red field. When hovering over that red field, an error message is shown.<br/> | <br/>{{info|1Archive automatically calculates the financial discount. When the ''VAT amount'' is not filled in correctly, this will be displayed by showing a red field. When hovering over that red field, an error message is shown.<br/> | ||

<br/>[[image:financial_discount_validator.PNG|link=]]<br/>}}<br/> | <br/>[[image:financial_discount_validator.PNG|link=]]<br/>}}<br/> | ||

| + | |||

| + | ==Financial discount and VIS== | ||

| + | By default, 1Archive will copy the payment term which is set on a supplier to the document. This value can be overwritten by any other payment term available.<br/> | ||

| + | When overwriting this value, the due date and financial discount will be adjusted.<br/> | ||

| + | <br/> | ||

| + | When booking the document, the financial discount will be taken over in Venice for that document.<br/> | ||

| + | Also when booking the document, the financial discount will be set to the payment order. This to allow you to use the financial discount when paying an invoice in Venice.<br/> | ||

| + | <br/>{{warning|The financial discount for payment orders will only be set for invoices, not for credit notes!}} | ||

Revision as of 12:01, 21 February 2017

1 Financial discount

The calculation of the VAT amount is always based on the taxable amount. This taxable amount will be different when working with a financial discount than when working with no financial discount.

1.1 Example

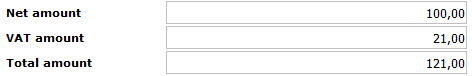

Let's say you have following document in 1Archive:

- Net amount: €100

- VAT percentage: 21%

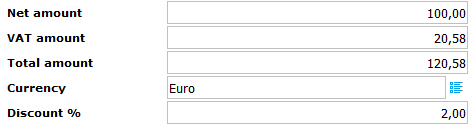

- Discount %: 2

In a normal situation, the VAT amount would be €21 and the Total amount would be €121.

A financial discount is in this case calculated based on the value in the Net amount field. The discount in this example equals €2 (2% of €100).

The taxable amount will therefor be equal to €98 (€100 - €2 discount).

Because the VAT amount is calculated based on the taxable amount, this value will equal €20,58 (21% of €98).

The Total amount in this case will be €120,58. And this is how this document should be booked into the accountancy package.

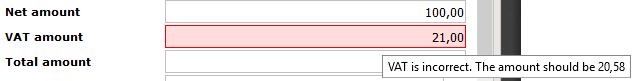

1Archive automatically calculates the financial discount. When the VAT amount is not filled in correctly, this will be displayed by showing a red field. When hovering over that red field, an error message is shown. |

2 Financial discount and VIS

By default, 1Archive will copy the payment term which is set on a supplier to the document. This value can be overwritten by any other payment term available.

When overwriting this value, the due date and financial discount will be adjusted.

When booking the document, the financial discount will be taken over in Venice for that document.

Also when booking the document, the financial discount will be set to the payment order. This to allow you to use the financial discount when paying an invoice in Venice.

| The financial discount for payment orders will only be set for invoices, not for credit notes! |